Ask Chuck: 5 Steps to Prepare for Tax Day

To learn Biblical answers to your financial questions, you can #AskChuck @AskCrown your questions by clicking here. Questions used may be lightly edited for length or clarity.

Dear Chuck,

Once again, tax day is almost here, and even though it's a little later than usual, on Tuesday, April 18, I'm still not ready. Any tips for me to avoid mistakes and make this as painless as possible?

Tense about Taxes

Dear Tense,

With three extra days to file beyond the traditional April 15th deadline this year, let's be sure we don't make careless mistakes. Beyond the 5 steps I'll explain below, my wife and I use these 8 tips to keep our filing is simple and stress-free every year. They can help you get ready, even if you're running behind schedule.

As Christians, we know that Jesus said, "give back to Caesar what is Caesar's, and to God what is God's." But it does take some work to follow through and avoid the typical problems with an incorrect return.

Step One: Organize all your documents. One favor you can do for yourself is to keep all the necessary papers together throughout the year, so that hide and seek is not the first step of your preparations. Things that you need to keep track of include:

- W-2 from employers or 1099s for contract work

- Records of charitable giving

- Expenses related to job hunting or business expenses that were not reimbursed by a client or employer

- Costs of a move

- Income earned through investments like real estate or stocks

The IRS has a handy checklist of documents you might need, depending on your work and resources.

Step Two: Review your work. With all your records in hand, do a first draft of your returns, and then take a break. The most common errors on tax returns are simple math mistakes, followed by computation errors, mistakes made when taxpayers miscalculate taxable income, withholding or other sums. Another common mistake on taxes is misspelled names or incorrect Social Security numbers. Be sure to go through your returns for accuracy of all the details. The IRS has a checklist for common errors and often missing forms - review it before sending in your returns. "Close enough" doesn't cut it for the IRS! Always double, and even triple check before submitting!

Step Three: Get wise counsel. Especially if you have complicated finances, getting help can be a wise investment. Yes, this service can cost money, but it is possible to reduce that cost if you work through your taxes first and then let someone check your math and assumptions. Proverbs 15:22 advises, "Without counsel plans fail, but with many advisers they succeed." Mistakes can cost you time and money. If the IRS believes you are in error, you'll receive a letter to begin a review, and if you are owed money you may wait up to a year to see the check. Considering that the average tax refund is $3,120, accuracy and timeliness are worth the effort to do it right the first time.

Step Four: Cut out the middleman. If possible, file electronically. The IRS notes, "Submitting your tax return electronically ensures greater accuracy than mailing your return. The e-file system often detects common errors and rejects your tax return, sending it back to you for correction. This could save you delays in processing your tax return. "The IRS has approved a number of companies, including 1040.com, Turbotax.com, H&R Block, even IRS.gov/freefile. If you are unsure about filing yourself, then go to IRS.gov, do your research, or hire someone to do it for you." Filing electronically also saves you from sitting in the line of cars at the Post Office on filing day, as people wait to get that date stamp on their returns.

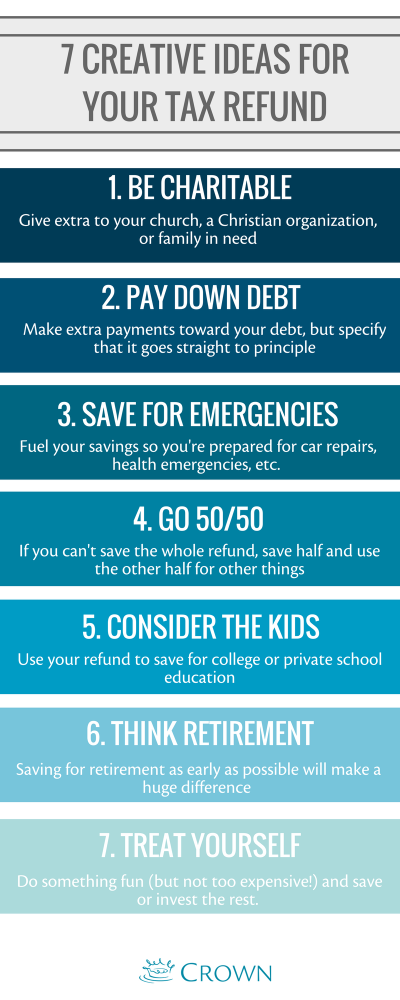

Step Five: Hold onto your cash. If you get a refund, don't be in a hurry to go shopping. Everyone needs to have at least $1,000 in savings for emergencies, a goal that many people can meet by setting aside their tax return. You can also learn more about how to manage your finances with Crown's Money Map.

If you're looking for a little encouragement in the year ahead, please accept this gift from Crown. You can receive practical principles and daily encouragement from God's Word in the God is Faithful devotional, sent straight to your inbox to consider what God has to say about our daily life.

To #Ask Chuck @AskCrown your own question, click here.