California Lawmakers Won't Get Paid Until Balanced Budget Submitted

California state Democrat leaders were dismayed when Gov. Jerry Brown, a fellow Democrat, vetoed the budget bill within 24 hours because “it didn’t go far enough” in closing the $10 billion deficit.

According to Brown, the spending plan had “legally questionable maneuvers, costly borrowing and unrealistic savings,” even as he commended Democrat lawmakers for their “tremendous efforts.”

The praise hardly cheered up Democratic lawmakers. The state controller said Tuesday in a written statement that they, along with other California legislators, would lose at least a week’s pay and allowances for passing a budget that was not balanced.

“My office’s careful review of the recently passed budget found components that were miscalculated, miscounted or unfinished,” said John Chiang, the state controller. “The numbers simply did not add up, and the Legislature will forfeit their pay until a balanced budget is sent to the governor.”

The “On-Time Budget Act of 2010,” a law approved by voters last year, authorizes the state controller to withhold lawmakers’ pay if they fail to pass a complete and balanced budget by June 15.

The June 15 budget underfunded education by more than $1.3 billion, while it counted on $320 million in hospital fees, $103 million in taxes on managed-care plans, and $300 million in vehicle registration charges. None of these measures are backed by the necessary corresponding legislation.

The budget passed last week had a $1.85 billion gap, said Chiang.

The state of California has a long history of fiscal woes. From the days of former governor Gray Davis, when the high-tech bubble burst and the state faced electricity crisis in the early 2000s, to the times of Arnold Schwarzenegger, when the real estate market slumped in 2007, California economy has been under the weather for quite awhile.

The Dilemma of Proposition 13

However, the mess California finds itself in has less to do with the above-mentioned financial set-backs than with what The Economist once called the “structural problems with the state’s finances.”

In a 2002 article, it said: “That structure is still dominated by an event 25 years ago: the anti-tax movement that gave rise to Proposition 13, a ballot initiative that capped property taxes. Not only were taxes of all sorts made harder to raise, but the state also had to rely on income tax for an ever-greater share of its revenue: it has risen from 18.5% of the total in 1970 to around 50%.”

This share has now risen to 56 percent, according to Sunshine Review.

A TIME magazine article reached the same conclusion when it looked deep into the budgetary crisis of 2009.

“At the root of California’s misery lies Proposition 13, the antitax measure,” it reasoned.

“Beholden to a tax-averse electorate, the state’s liberals and moderates have attempted to live with Proposition 13 while continuing to provide the state services Californians expect - freeways, higher education, prisons, assistance to needy families and, very important, essential funding to local government and school districts that vanished after the antitax measure passed.

“Now, however, that balancing act no longer seems possible,” the June 27 article concluded.

This was followed up a few days later by another article in the same magazine on July 1, at the beginning of the new fiscal year. It recognized that Proposition 13 was a “two-edged sword.” While it protects people from sudden and wild government taxes, it couldn’t find a sure way to provide people with the services that they wanted.

Commenting on Proposition 13, The New York Times, around the same time, observed that, “While the state’s property taxes are below average, its personal income tax rate and levies on capital gains are among the highest; so unlike states that pass the tax burden around, California can become disastrously imbalanced.”

To address the basic shortfalls in the budget, Gov. Brown has demanded that Republican lawmakers support extending of three expiring taxes. He needs two Republican legislators to come on board form each of the two houses, so that he has two-thirds majority to approve his plan.

The Initiative of Faith

While Democratic lawmakers worry about possible deal with their Republican counterparts in the coming days, it would be worthwhile to revisit a positive initiative by the San Diego-based megachurch, which gave $9.6 million in volunteer hours to California.

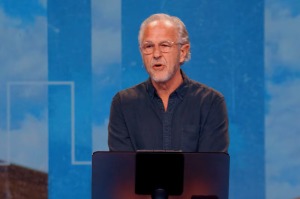

In 2009 during one of the worst phases of the economic crisis, the Rock Church, founded by former NFL player-turned-pastor Miles McPherson, contributed to the state’s economy in practical terms: it donated 615,956 hours of community service to the city of San Diego, which translate to $9.6 million worth of service to the community.

McPherson’s book, Do Something: Make Your Life Count, challenges churches across the country to mobilize people to serve their community and share Christ’s love beyond the walls of the church.

The church also runs a companion Web site, www.dosomethingworld.org, that provides suggestions on how to get involved in community service.

In recognition of the church’s role in community service, the mayor of San Diego, Jerry Sanders, declared March 8th, as “Do Something Day” in the city of San Diego.

The megachurch kept the faith and in 2010 it set itself a goal of 700,000 hours of volunteer service to the city. Even as lawmakers battle it out behind closed doors, the church has taken a conscious decision to make a difference at local levels. The goal is to alleviate problematic areas in the city due to budget cuts, it said on its Web site.

The next Do Something World San Diego Day is announced to be on July 10, 2011.