Building Financial Freedom: A Legacy of Faith and Stewardship

Sarah stared at the stack of bills on her kitchen table, a familiar knot forming in her stomach. As a homeschooling mother of three, she and her husband, Mark, had made the intentional choice to prioritize their children's education and spiritual growth. But like many families walking this path, they often found themselves caught between their convictions and their checkbook.

"We're doing the right thing," Mark had said countless times, "but why does it feel like we're always struggling financially?"

Their story isn't unique. Across the country, thousands of Christian families face similar challenges—balancing their desire to live according to biblical principles while navigating the practical realities of mortgages, groceries and educational expenses. The desire for financial freedom isn't about accumulating wealth for its own sake; it's about creating the margin to live generously, serve others and pass down a legacy of faithful stewardship to the next generation.

The Foundation of True Financial Freedom

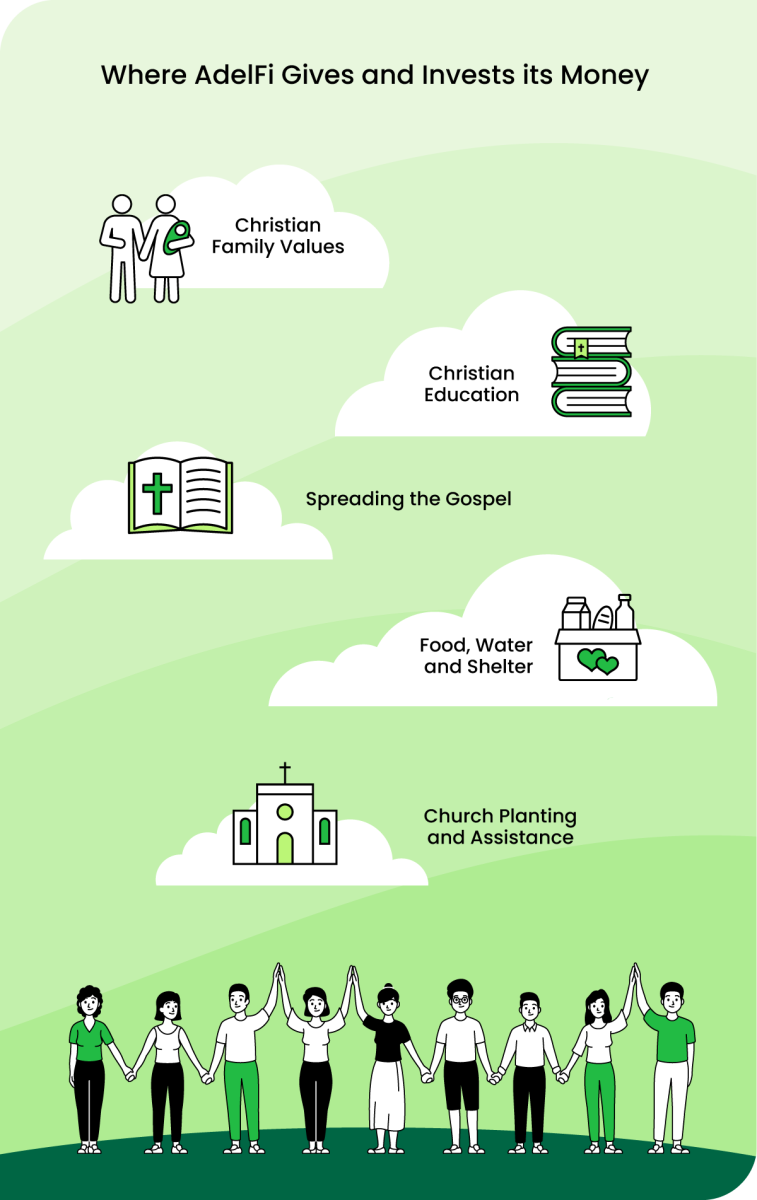

At AdelFi, we understand that financial freedom for Christian families looks different from the world's definition. It's not about having enough money to buy whatever you want—it's about having the resources to do what God has called you to do. Whether that's supporting missionaries overseas, investing in your children's education or simply being able to respond generously when a neighbor faces unexpected hardship, true financial freedom creates space for kingdom impact.

This understanding shapes every resource we provide to our members. Our biblically-based financial stewardship courses aren't just about budgeting techniques or investment strategies—though those elements are certainly important. Instead, they're designed to help families like Sarah and Mark's develop a comprehensive understanding of how God views money and how we can align our financial decisions with His purposes.

When families begin to see their finances through this lens, transformation happens. They discover that financial responsibility isn't about restriction; it's about creating the freedom to live according to their deepest values and respond to God's leading without the constant stress of financial uncertainty.

Equipping Families for Generations

The impact of financial literacy extends far beyond individual households. When parents understand biblical principles of stewardship, they naturally begin passing these lessons to their children. This is especially powerful in homeschooling families, where parents have the unique opportunity to integrate financial education into their children's daily learning experience.

Consider the ripple effect when a family learns to distinguish between needs and wants, to practice delayed gratification and to view their resources as tools for blessing others. These aren't just financial skills—they're character-building exercises that shape how children will approach every aspect of their lives.

Our partnership with organizations like Teach Them Diligently and institutions such as Judson University and Central Christian College of Kansas reflects this long-term vision. We're not just providing financial services; we're investing in the next generation of Christian leaders who will carry forward principles of biblical stewardship into their careers, communities and families.

When homeschooling families access our complimentary financial courses, they're gaining more than budgeting tools. They're receiving a comprehensive framework for raising children who understand that everything they have belongs to God and that wise stewardship is both a privilege and a responsibility.

Breaking the Cycle of Financial Stress

Many Christian families find themselves trapped in cycles of financial stress that seem impossible to break. They want to give generously, invest in their children's futures and respond to ministry opportunities, but they feel constrained by debt, insufficient savings or simply the overwhelming nature of managing money well.

The path to financial freedom often begins with small, consistent steps rather than dramatic changes. Families start by creating simple budgets that reflect their values, setting aside modest amounts for emergencies and learning to make financial decisions based on prayer and principle rather than impulse or pressure.

As these habits take root, families discover something remarkable: financial responsibility actually creates more options, not fewer. When you're not constantly worried about making ends meet, you have the mental and emotional space to notice opportunities for ministry, to respond to others' needs and to make thoughtful decisions about major purchases or investments.

This transformation often extends beyond the immediate family. Parents who have learned to manage money according to biblical principles become natural mentors to other families facing similar challenges. They share practical wisdom about meal planning, budgeting for school supplies and homeschool materials and finding creative ways to lower expenses without sacrificing quality of life.

The Long View of Stewardship

True financial freedom isn't achieved overnight, and it doesn't mean the absence of financial challenges. Instead, it represents a fundamental shift in how families approach money—from seeing it as a source of stress to viewing it as a tool for kingdom impact.

Families who embrace this perspective often find that their definition of success changes as well. Rather than measuring progress solely by net worth or income growth, they begin to evaluate their financial health based on their ability to be generous, responsive to God's leading and faithful in stewarding the resources they've been given.

This long-term view of stewardship creates a powerful legacy. Children who grow up in families practicing biblical financial principles don't just inherit money—they inherit wisdom, character and a framework for making decisions that honor God and serve others.

As we look toward the future, we're committed to expanding our resources and partnerships to serve even more families on this journey. Because when Christian families experience true financial freedom, the impact extends far beyond their own households—it strengthens churches, supports ministries and creates a foundation for generational blessing that will continue for years to come.

The path to financial freedom begins with a single step: the decision to align your financial choices with your faith. From there, with the right resources, community support and commitment to biblical principles, families can build the financial stability that creates space for generous living and kingdom impact.

Discover how your banking can reflect your values—explore AdelFi Credit Union today.