Pastors' parsonage exemption: What would televangelists pay if their mansions weren’t tax exempt?

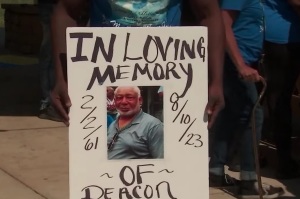

David E. Taylor

By purchasing a mansion through his church, televangelist David E. Taylor saves over $150,000 in annual property taxes.

In April of 2022, The Kingdom of God Global Church purchased a parsonage for Taylor at a cost of $8.3 million.

Before Taylor’s church purchased the mansion, the Hillsborough County Florida property tax on the property was $155,715.20 — but after the purchase the property tax dropped to just $1,404.11.

According to Hillsborough County’s tax assessor website, the miniscule 2023 tax on the property has still not been paid.