Foreign financial reporting: When church and ministry money travels to foreign countries

Researchers at the Center for the Study of Global Christianity, writing for the International Bulletin of Mission Research, estimate that $55 billion will be spent on foreign missions in 2023. That may seem like a lot, but the same researchers also estimate that Christian religious leaders will embezzle $62 billion in 2023.

Foreign mission organizations are notorious for their lack of transparency. Gospel for Asia, which raises millions of dollars to support missionaries, doesn’t disclose to donors important financial information such as total annual revenue, total annual expenses, or compensation for highly paid executives.

Compounding the problem, American tax laws are poorly understood and poorly enforced, often resulting in noncompliance. If a church operates a mission project in a foreign nation with a foreign bank account and the foreign account exceeds $10,000, the church is required by the Bank Secrecy Act to file a Report of Foreign Bank and Financial Accounts (FBAR).

To make matters worse, if a church or ministry reports a foreign bank account, the report is confidential and cannot be revealed to church or ministry donors. Corrupt religious leaders can engage in international money laundering and the existence of their foreign bank accounts are shielded by privacy laws.

Australian charity rules

Some countries such as Australia have stricter laws regarding foreign reporting and foreign expenditures for churches.

In 2022, Hillsong Church employee Natalie Moses turned whistleblower. Moses served as Fundraising & Governance Coordinator for Hillsong Global Corporate Group.

According to Moses' statement of claim, Brian Houston, the founder and former senior pastor of Hillsong "announced that $10,000 would be given to persons who were his former interns and who had sought to start a 'Hillsong' Church in Bucharest, Romania."

Moses responded by informing a supervisor that direct cash payments to individuals in Romania by Australian non-profit organizations were prohibited.

To avoid violating Australian law, Hillsong Global LLC (an American non-profit limited liability company) transferred the funds. Meanwhile, Hillsong Global does not file a Form 990 disclosing its foreign spending because American churches and church-integrated auxiliaries are exempted from filing the non-profit information return.

Moses raised additional concerns that Hillsong was failing to comply with Australian laws.

Australia has adopted Four External Standards which regulate foreign non-profit spending and reporting. Australian churches are not exempt from these standards.

The Australian Charities and Not-for-Profits Commission requires foreign financial records to be "complete, accurate and legible." Australian churches and ministries should compile a list of all foreign third-party organizations they collaborate with. Non-profit organizations are expected to document criminal and illegal activities committed by employees after misconduct is discovered.

Unfortunately for Australian Christians, these complete records are not available for church donors. Instead, they must be made available to government officials that request them.

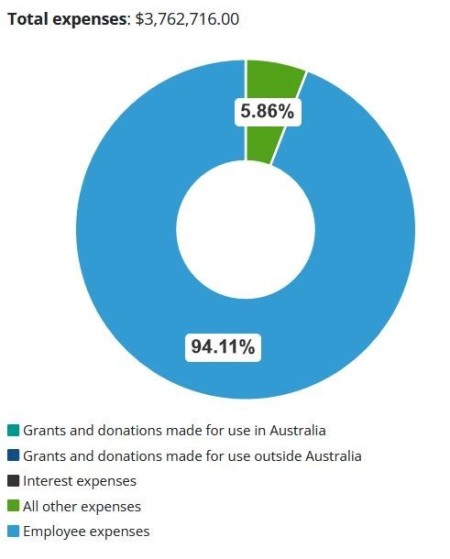

The Australian Charities and Not-for-Profits Commission provides basic financial information for Australian churches and ministries, but good luck finding Hillsong Church’s foreign missions expenditures.

(Photo: Hillsong Church Ltd. reporting no foreign expenditures for 2021.)

Canada and the United Kingdom also have searchable charity registries with minimal financial data.

Foreign financial investments and spending disclosures on 990s

In the United States, non-profits (except for churches, synagogues, mosques, and other places of worship) are required to file a Form 990 which discloses total revenue, total expenses, and compensation of highly paid executives.

990s help concerned donors evaluate the financial effectiveness of an organization. The disclosed information also helps journalists to “follow the money” when investigating a charity’s operations.

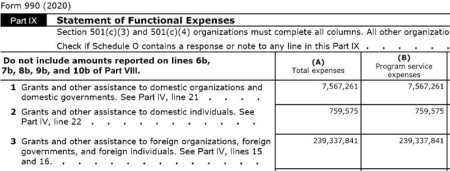

The following photos of 990s provide examples of large religious ministries revealing foreign assets and expenditures.

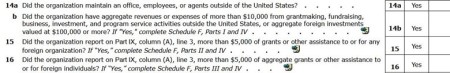

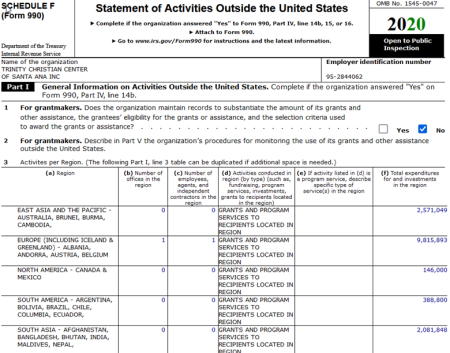

When a non-profit responds with yes to the questions on Page 3 lines 14a through 16, it must also fill out Schedule F describing activities outside the United States. A review of line 14a will show if a non-profit has offices or employees overseas.

(Photo: Trinity Christian Center of Santa Ana discloses foreign offices and expenditures.)

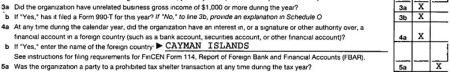

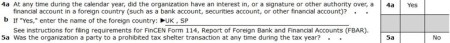

Form 990s (page 5 lines 4a and 4b) may indicate if a non-profit organization has foreign bank accounts or foreign investments.

(Photo: Liberty University disclosed foreign investments in the Cayman Islands for fiscal year ending June 30, 2015. Liberty no longer reports foreign investments.)

Ministries often use country codes to disclose foreign accounts and investments.

(Photo: In 2020, Trinity Christian Center of Santa Ana, an affiliate organization of TBN, disclosed foreign accounts in the United Kingdom and Spain.)

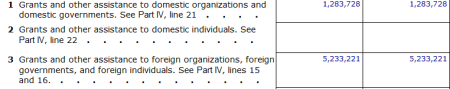

Page 10 line 3 discloses financial assistance and grants given to foreign individuals and foreign organizations.

(Photo: Trinity Christian Center of Santa Ana discloses foreign grants and assistance in 2020.)

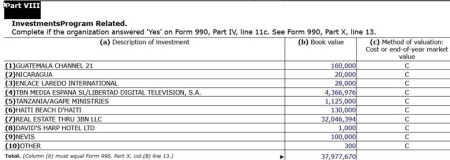

Foreign investments are sometimes disclosed in Schedule D. The following photo lists Trinity Broadcasting Network investments in Africa, Latin America, and the Caribbean.

(Photo: Trinity Christian Center of Santa Ana 2020 Form 990)

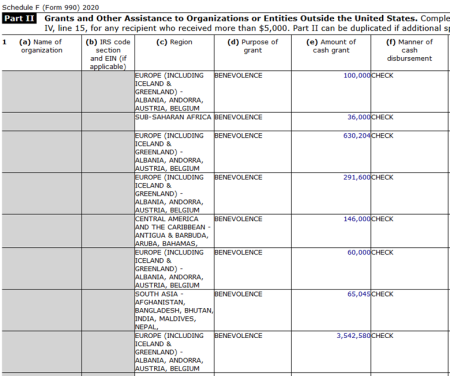

Schedule F, which contains lists of foreign grants and foreign benevolence donations, is where the most detailed information about foreign financial transactions is disclosed.

Several years ago, Matthew and Laurie Crouch restructured Trinity Broadcasting Network. Trinity Christian Center of Santa Ana ceased to be the parent organization of TBN. That role was transferred to Trinity Broadcasting of Texas. Meanwhile, most of TBN’s foreign financial transactions continue to be performed by Trinity Christian Center of Santa Ana. Trinity Broadcasting of Texas didn’t report any foreign financial accounts in 2020.

The photo above reveals that Trinity Christian Center of Santa Ana sent a check for over $3.5 million to a mystery organization in 2020.

Even stranger, the Internal Revenue Service (IRS) doesn’t require non-profits to disclose the names of organizations receiving grants overseas, hence the first two columns in the photo above are greyed-out.

Meanwhile, the IRS has the power to request additional information and penalize non-profit organizations filing incomplete 990s. Trinity Foundation is encouraging the IRS to take aggressive action in response to incomplete 990 information returns.

The Christian organizations spending the most money or providing the most assistance in foreign nations tend to be disaster relief ministries and foreign mission agencies.

(Photo: Each year churches across America collect shoeboxes of Christmas gifts which are sent to Samaritan’s Purse and distributed globally through the Operation Christmas Child project. The value of Christmas gift boxes is included in line three shown in the picture above Samaritan’s Purse 990s.)

In 2020, Samaritan's Purse distributed 9,123,202 Christmas gift boxes in more than 100 nations. According to a 2020 audit of Samaritan’s Purse, the total Operation Christmas Child project cost $284.6 million. This total includes the processing and distribution cost of the project which would be included on other lines of Form 990.

Home and world missions

While churches and associations of churches are exempt from filing 990s, some mission organizations voluntarily file.

In the Southern Baptist Convention, home missions (mission work performed in the United States) are performed through the North American Mission Board. International mission work is performed through the International Mission Board, which is a member of the Evangelical Council for Financial Accountability (ECFA). Neither missions organization files a Form 990.

Other sources for financial information are annual reports published on mission board websites and membership profile pages on the ECFA website, which feature a very limited set of financial information but don’t provide detailed foreign financial reporting.

There is one compelling reason for missions organizations avoiding transparent financial reporting. Since 1985, the Southern Baptist Convention has mobilized to send missionaries and plant churches among unreached people groups. Missionaries are being sent to places where it is often dangerous to serve publicly. However, this should not be used as an excuse for avoiding financial reporting entirely.

Church and ministry donors have a responsibility to check out the organizations they financially support. But, how can they make responsible decisions if there is not enough financial information available to evaluate the effectiveness of the organization?

What is the average cost to send a missionary to serve in Southeast Asia? How much is the average cost to plant a church among an unreached people group? The answers to such questions might inspire more people to support world missions.

Barry Bowen is staff investigator at Trinity Foundation, a nonprofit organization that investigates religious fraud, theft and excess. From 2005 to 2010 Bowen served as one of the third-party whistleblowers assisting the U.S. Senate in its investigation of six TV ministries.