Pastors' parsonage exemption: What would televangelists pay if their mansions weren’t tax exempt?

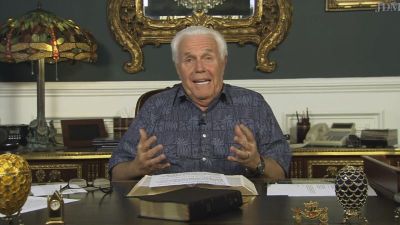

Jesse Duplantis

In 2015, while preaching at the Southwestern Believers Convention, Duplantis joked about how his parsonage will be destroyed on judgment day, “God will burn it down.” Then, Duplantis said, “To build that house is $500 a square foot. It’s 40,000 square foot. … You do the math.”

Duplantis exaggerated the size of his plantation-style home. When the parsonage was under construction the St. Charles Herald Guide reported, “The home consists of 22,039 square feet of living space in addition to 12,947 square feet of accessory areas such as outdoor patios and garages.”

If Duplantis’ home wasn’t tax-exempt and was appraised at $20 million, which is the amount Duplantis says it is worth, the property tax would be approximately $122,000, according to the Smart Asset property tax calculator. Property tax rates are lower in Louisiana because the state has an income tax unlike its neighbor Texas.