9 Things You Need to Know About the Republican Tax Overhaul

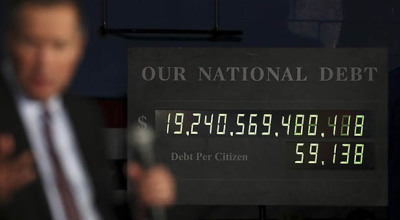

8. National debt to increase

Among one of the biggest critiques of the Republican tax plan is that it will increase the national debt.

According to the Congressional Budget Office, based upon analysis from the Joint Committee on Taxation, a congressional committee in charge of evaluating the tax proposal, the bill would add $1.7 trillion to the national debt over the next 10 years.

That analysis doesn't account for the economic growth likely to result from the tax cuts, which Republicans argue will offset some of the lost revenue.

Meanwhile, other analyses of the tax plan have been less optimistic of the tax bill's impact on the national debt.

"The final conference committee agreement of the Tax Cuts and Jobs Act (TCJA) would cost $1.46 trillion under conventional scoring and over $1 trillion on a dynamic basis over ten years, leading debt to rise to between 95 percent and 98 percent of Gross Domestic Product (GDP) by 2027 (compared to 91 percent under current law)," the Committee for a Responsible Federal Budget, argues. "However, the bill also includes a number of expirations and long-delayed tax hikes meant to reduce the official cost of the bill. These expirations and delays hide $570 billion to $725 billion of potential further costs, which could ultimately increase the cost of the bill to $2.0 trillion to $2.2 trillion (before interest) on a conventional basis or roughly $1.5 trillion to $1.7 trillion on a dynamic basis over a decade. As a result, debt would rise to between 98 percent and 100 percent of GDP by 2027."

Analysis from the right-of-center Tax Foundation estimates that the tax bill will add about to $448 billion to federal deficits over 10 years when economic growth is factored in.