Church Legal Expert: Minister Housing Tax Break Under Attack

As tax time begins, church legal expert Richard Hammar warns ministers, pastors and clerics to be mindful of a legal battle that has strong financial implications on their personal and church taxes in 2011.

In the January 2011 issue of Church Law & Tax Report, Hammar highlights tax developments, drawing special attention to a California court case that threatens to extinguish a federal tax break which dates back to 1954, the parsonage exemption.

Many churches give their pastors and ministers an allowance to help ease housing-related expenses, such utility bills, repair and yard work costs. The parsonage exemption allows ministers to receive this money free of any federal, and in parts of the country, state taxes.

However, a lawsuit set for trial in 2011 threatens the constitutionality of sections 107 and 265(1)(6) of the federal tax code, which establishes the housing allowance for ministers.

Atheist group Freedom from Religion Foundation filed the federal lawsuit in 2009. The group asserts the unique benefit set aside especially for "ministers of the gospel" is a violation of separation of church and state.

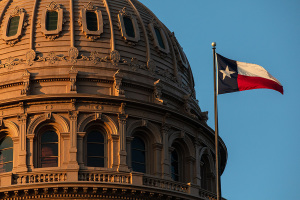

The FFRF cites the 1989 U.S. Supreme Court case Texas Monthly, Inc. v. Bullock to assert that tax benefits given only to religious institutions violate the Constitution's Establishment Clause.

FFRF Co-President Annie Laurie Gaylor states in a 2009 press release that the benefit is unfair to those who are not religious ministers.

"All other taxpayers pay more because clergy receive this privileged benefit," she proclaimed.

But the late U.S. Rep. Peter Mack, Jr. declared at the making of the amendment that the benefit levels the playing field in a "godless world."

"Certainly, in these times when we are being threatened by a godless and antireligious world movement we should correct this discrimination against certain ministers of the gospel who are carrying on such a courageous fight against this foe. Certainly this is not too much to do for these people who are caring for our spiritual welfare," Mack affirmed.

Just this May, a federal court judge allowed the case to continue to trial. Hearings will likely occur in the fall of 2011.

Dan Busby, president of evangelical financial accreditation group ECFA, says of the lawsuit, "This is a really big deal for ministers."

Removing the exemption would mean less money for bills and family expenses, Busby explains. He shares that the exemption would also cost churches, to which ministers will likely turn for financial help. Churches with many ministers, he adds, will be especially impacted by change to the exemption.

"It would seem to put a bigger burden on churches," he shares.

Hammar states the elimination of the housing allowance would have an immediate and catastrophic financial effect on hundreds of thousands of ministers who have purchased their home and secured a mortgage loan relying exclusively on the housing allowance.

No ruling has yet been made in the lawsuit, and no changes have been made to the tax code allowing the parsonage exemption. Busby believes that any ruling in the case will be appealed to the Supreme Court. He estimates this will take several years and urges churches not to be too alarmed.

Still, Hammar insists that church ministers and clergy take note of the lawsuit's implications. He also urges them to pay attention to changes in the tax code that he says will directly affect clerics and churches in America.

He says employers of a small number of workers, such as many churches, are currently eligible for a refundable tax credit as inducement to obtain health insurance for their employees. However, the credit is limited. After 2012, legislation changes will put a limitation on employee heath flex spending arrangements.

Hammar shares more church tax advice in the 2011 Church & Clergy Tax guide to be released next month. The publication is a product of non-profit communication ministry Christianity Today International.