New Church Parking Tax, Filing Requirements Trigger Fresh Debate on Financial Transparency

At least one religious watchdog group said Wednesday that the newly instituted Tax Cuts and Jobs Act that applies the federal income tax to parking benefits provided by churches, is a step in the right direction towards transparency in church finances, as the Evangelical Council for Financial Accountability wages a campaign to repeal it.

"Even if it affects our own church, I would vote yes [to the provision]," Pete Evans, lead investigator at the Dallas-based Trinity Foundation, which has been tracking religious fraud and helping victims of religious fraud for almost 30 years, told The Christian Post.

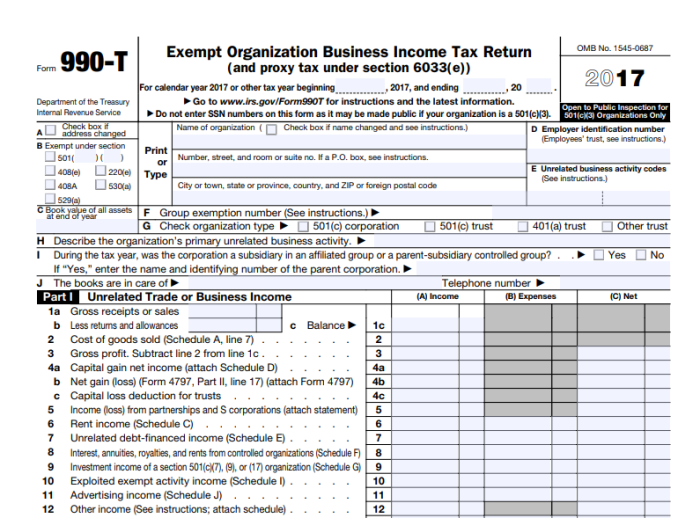

As a result of the new provision many historically tax‐exempt employers, including churches, hospitals, charities, and schools will be required to file federal Form 990‐T, which accounts for unrelated business activity. In many cases, these tax-exempt organizations will also have to file state corporate income returns every year regardless of whether they actually engage in any unrelated business activity, according to the ECFA. This new requirement, argues ECFA's president Dan Busby, is likely to create various administrative and financial costs for many churches who do not have the means to meet them.

"Working in the church world most of my career, my guess is that prior to this provision, there's probably only one or two percent of churches in America that file form 990-T so we're really talking about two issues," Busby told CP Tuesday.

"We're talking about a financial issue. We're gonna have to pay a tax on providing employee parking and two – which may be more important – is the administrative piece of this. To file a return with which they are not familiar. If you can imagine, small churches across America have to file a form 990-T that they've never even heard of. And probably they're gonna need to secure professional advice and pay a professional to file the return, even though the money may not be a significant amount, it's just a ridiculous provision that was put in the law," he said.

Checks by CP on a database available on the IRS website confirmed that some churches are already filing various 990 forms, including the 990-T. Evans argued, however, that even though Busby makes some valid points in favor of the smaller churches, he believes the new reporting requirement will help in the push toward transparency in larger churches.

"You have all these churches now and ministries that are wealthy beyond wealth and some of which have thousands and thousands of acres in the counties that are not on the tax rolls because of various exemptions and they are living like Arabian princes," Evans said.

Churches like Savannah Church of Christ in Georgia, which is registered as a 501(c)(3) corporation, have filed detailed 990 forms with the IRS reflecting compensation information for officers. While the IRS requires 501(c)(3) tax-exempt organizations to file annual returns and make them publicly available, churches are under no such obligation.

The churches that choose to file returns, according to Nolo, do so to obtain official recognition of its tax-exempt status to assure donors that their contributions are tax deductible, and ensure they will be listed in IRS records as a qualified charitable organization. Indeed, some 990-T filings submitted by churches to the IRS and viewed by CP contain no information at all.

Busby argued that the 990-T required under the new provision will only provide transparency on parking.

"The only thing a 990-T would provide transparency about is whether they [churches] provided parking space for their employees. I can't imagine anybody that's really interested in that information," Busby said.

"It would impede the work of churches, the work of non-profits and [of] all things the federal government should not do is hinder the work of churches, houses of worship, non-profits that are doing good works," said Busby.

"We didn't see this coming and now that we understand it we think it just needs to be reversed. I believe any clear-eyed member of Congress on either side of the aisle would vote to reverse this because I don't think they understood it when they passed it," Busby added.

Evans however questioned Busby's apparent concern for smaller churches in his criticism of the ECFA.

"If you look at the majority of people that ECFA represents, they represent the larger churches because ECFA charges so much money that small churches can't afford to be members of ECFA and so I think there is hypocrisy there that on one hand they're getting a lot of money from the larger ministries, churches and now all of a sudden they are defending the little churches?" he said.

"ECFA does not reveal salary information of their clients and that's one of the key aspects of transparency that they're hiding their own clients. They give everybody a seal of approval, this organization is good and above board and yet don't reveal salary information? What's up with that?" he asked.

"Especially for the larger ministries and churches, there needs to be some transparency because they're not gonna do it on their own. Churches, if they are not required to are typically not going to be transparent on their own and I think a lot of churches would be willing if there was a requirement," Evans added.

Reacting to Evans' criticism on Wednesday however, Busby said while the ECFA "is trying to assist all Christian churches and nonprofits regarding the parking tax Position Statement," membership in the organization requires an independent audit and very few small churches are able to meet that standard.

"Most of ECFA's church members are larger in size because the organization requires its members—churches and nonprofits—to have an audit, review or compilation conducted by an independent CPA. Very few small churches in America have a CPA-prepared audit, review or compilation," he said.

Addressing the concern about the lack of salary disclosure of members, Busby said the ECFA is simply following the law.

"There has never been a legal requirement for churches to disclose their salaries. ECFA's standards start with legal requirements, and in some cases, go beyond the law. In the case of church salaries, there has never been a legal requirement for churches to disclose the salaries of their employees, and thus disclosure is left to the discretion of the local church," he said.