Should I cosign a loan?

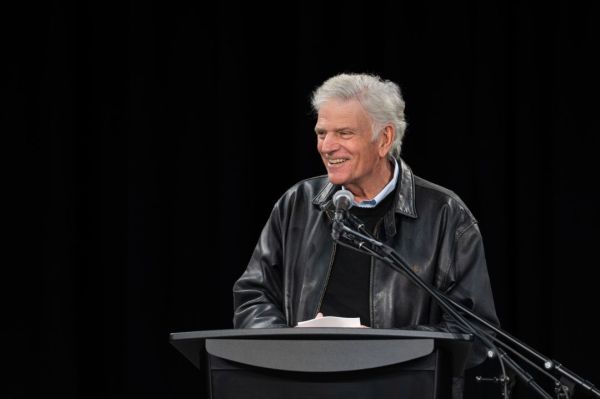

To learn Biblical answers to your financial questions, you can #AskChuck @AskCrown your questions by clicking here. Questions used may be lightly edited for length or clarity.

Dear Chuck,

So, I cosigned for a student loan and now I’m stuck paying for it. Is there anything I can do?

Regretful

Dear Regretful,

Unfortunately, the same thing happened with my Dad and we have not found a satisfactory remedy. He was approached by an employee whose son needed assistance to get a “head start in life.” Because my father wanted to help and believed the story that the young man would respect those who helped him do what no other family member (of this boy) had ever achieved, he cosigned for a large student loan. As soon as the boy graduated, his mother quit her job at my father’s company and he never heard from either of them again. He was conned.

While I am tempted to reveal the person’s name since he has flaunted his achievement by driving expensive cars and living the high life while refusing to even return a phone call from my elderly father about his student loan obligation, I will refrain from using my platform for hurting others and instead use it to warn others.

It’s easy to make an emotional decision when trying to help a friend, family member, or person in need. But trouble brews when emotions overrule God’s Word.

When someone cosigns for a borrower who is honorable and responsible, payments are made in a timely fashion and no problems occur. But, when someone does not pay on time, either by choice or by circumstances outside their control, the cosigner is stuck, sometimes completely unprepared to pay the balance due.

Surety and Cosigning Defined

Surety is the principle of taking on an obligation to pay or to make a pledge for an obligation. When a borrower cannot get approval for a loan, a cosigner makes it possible by loaning their credit worthiness, thus reducing the risk for lenders. Cosigners are simply people with decent credit and credit history who guarantee payment of a loan should the prime borrower fail to make payments.

Responsibility of Cosigner

- Subject to all payments and late fees the primary borrower does not pay.

- Cosigned loans or credit cards are listed on credit reports.

- To communicate with the borrower to encourage, remind and praise timely payments.

- Get notification if payment is not made.

- Know the state’s laws on co-signing.

Consequences for Cosigner

- Late payments negatively affect credit scores.

- A legal judgment can be filed if the loan goes to collections.

- Wages can be garnished until the debt is paid in full.

- If the primary borrower files bankruptcy a consigner must pay the balance.

- Possible tax liability.

- Strained and possibly ruined relationships.

A Few Options

- Tangible debt (as with a house or car) can be sold and the proceeds applied to the loan.

- Borrower can refinance or consolidate the loan at which point a cosigner should bow out.

- If left with the loan, cosigner should try to work out a payment plan with the borrower.

- If left with the loan, cosigner should negotiate with the lender, refinance or consolidate for better terms.

- Purchase term life and disability insurance for a student if cosigning student loans.

- Determine the risks to your own credit before cosigning for anyone.

Another Option: Cosigner Release

This is an important provision for some student loans. Upon graduation and once working full-time, former students should pursue cosigner release. There are numerous requirements but this protects graduates and cosigners in the long run.

What the Bible Says

Surety is the primary means our society uses to “buy now” and “pay later.” Many Christians, ignorant of what the Bible says, cosign because they genuinely want to help family or friends.

But, one of God’s financial principles is avoiding surety. It keeps His people on the correct financial path and protects them from traps set by the world’s economic system. Those who take on surety pledge their future and presume upon God’s will.

One who lacks sense gives a pledge and puts up security in the presence of his neighbor. (Proverbs 17:18 ESV)

Whoever puts up security for a stranger will surely suffer harm, but he who hates striking hands in pledge is secure. (Proverbs 11:15 ESV)

The plans of the diligent lead surely to abundance,but everyone who is hasty comes only to poverty. (Proverbs 21:5 ESV)

When someone asks you to cosign, explain that it goes against Biblical principles. Use the opportunity to offer to teach basic personal finance, direct them to Crown’s online study and explain that you want to avoid souring your relationship over money. If they do need a loan, suggest they consider the following options.

Ways toGet a Loan Without a Cosigner

- Build credit

- Pay down debt

- Fix errors in credit reports

- Add income

- Borrow less

- Search other lenders

- Pledge personal collateral

In Your Case

While you did not reveal your relationship with the original borrower of the student loan, most often this problem occurs between family members when the student looks to parents, stepparents or grandparents for help. Try to preserve your relationship with the one who has defaulted and left you responsible for the debt. Pray for them to have a change of heart or circumstances to enable them to take back over the loan at some point. Go so far as to ask how you can assist them in getting in a position to be able to take back the obligation for the loan. Since you have no other remedy that I am aware of, do your best to pay the note in full and ask the Lord to work it together for good in a mysterious way only He can do.

Thanks for asking your question. I hope your pain will help many others like you and my Dad avoid a similar plight. That would create some good out of it all.