Ask Chuck: A financial tool you must have!

Dear Chuck,

My wife and I are finally living on a budget! What are some key steps in our financial plans that we should aspire to achieve now?

Getting Our Act Together

Dear Getting Our Act Together,

Bravo! I read some years ago that about 60% of people say they need or desire to live on a budget, but only 20% actually do it. This is consistent with what I have seen with those I have counseled through the years. Getting this done is a significant step towards financial freedom that will allow you to live on less than you earn while giving, saving, and investing.

A general answer to your question is to follow the steps outlined in the Crown Money Map; however, I was recently reminded of another important financial milestone that I think will help you and your wife. In fact, I think everyone, single or married, should have The Notebook.

The notebook

I recently visited a class at church where a couple shared their story. They first connected with Crown in 1976, the year Larry began his ministry! They read his books, taught the Crown courses, and have been united in their desire to be good stewards throughout their entire marriage. It was a joy to hear how God had brought them through the ups and downs of their financial circumstances over the nearly 50 years of their marriage. However, the main focus of their class was simply called The Notebook.

Their key point was that very few couples are fully aware of everything they need to know if one or the other were to die unexpectedly. The proverbial question is, “What would we do if one of us were to get run over by a bus?” Of course, nobody thinks it will happen to them, so they told stories of couples, young and old, who found themselves scrambling to know what to do in the fog and confusion of the death of a spouse. One widow in her mid-40s did not even know the addresses of the rental properties they owned. Her husband had managed all of the details of their finances. Not only was she in a deep valley of pain and grief, but she was also overwhelmed with trying to sort through their financial affairs.

Set your house in order

Hezekiah was instructed to set his house in order:

“In those days Hezekiah became ill and was at the point of death. The prophet Isaiah son of Amoz went to him and said, “This is what the Lord says: Put your house in order, because you are going to die; you will not recover” (2 Kings 20:1 NIV).

To accomplish this, our instructors walked us through their “notebook” system. It is a collection of instructions and records for those left behind in the event of one’s death (or even extended hospitalization). I have known and heard of too many widows who could not access important accounts or find valuable documents with the sudden passing of a spouse. This would be a great task to complete over the holidays.

Buy a large notebook that can hold all of your key documents, either originals or copies, with the location of the originals included. Once completed, agree to store it in a safe place for easy access, and notify next of kin where that is. This is a valuable gift to loved ones that should be updated annually or whenever passwords or other important information change. To get you started, here are the recommended contents:

The notebook

- Essential Calendar: Surviving Spouse Checklist by Bare Wealth Advisors and Crown.

- Obtain death certificates (10–15, depending on the size of the estate/organizations to be notified).

- Notify immediate family, close friends, and employer: list phone numbers, and ask family to assist. Contact the Veterans Administration if applicable.

- Funeral wishes and obituary information: include an obituary sample.

- Medical Instructions: organ donation, life support, health history, etc.

- List of Advisors: contact information for lawyer, accountant, financial advisor, etc.

- Explanation of will and trusts in your own words. Keep it simple.

- Social Security: recent statement and explanation.

- Life Insurance: recent statements and explanation.

- Medical/Dental Insurance: recent statements and explanation.

- Cash: list checking and savings account information along with automatic payments.

- Brokerage Accounts: recent statements and clarifying notes.

- IRAs, 401K Accounts: recent statements and clarifying notes.

- Personal Property: cars, real estate, collections, etc.

- List of Debt: mortgage, loans, credit lines, etc.

- Credit Cards: account information, cancellation instructions, automatic payments, etc.

- Tax Return Information: location of prior returns.

- Death Proceeds: advice and wishes regarding distribution and investment.

- List of Memberships that can be canceled upon death: clubs, gyms, etc.

- Passwords: location and access instructions.

- Budget Copy: last year’s household spending plan.

- Location of important documents: deeds, titles, policies, certificates, etc.

- Keys or code: safe deposit box, safe, etc.

- Personal Notes.

If you want a concise guide to walk you through the organizing process, I highly recommend Brian Kluth’s 40-page Legacy Organizer. It contains these topics. Crown also has a guide called Blueprint For Your Family’s Finances, complete with forms and worksheets for short- and long-term planning.

It takes some time and discipline to get this done, but just like the work you put in to complete your budget, it will be worth it. You will both appreciate the peace of mind of knowing your house is in order.

To gain more wisdom and insight into how you can effectively steward God’s resources — both time and money — the Crown Stewardship Podcast can be valuable. You can subscribe for alerts of new episodes. I hope you find it beneficial.

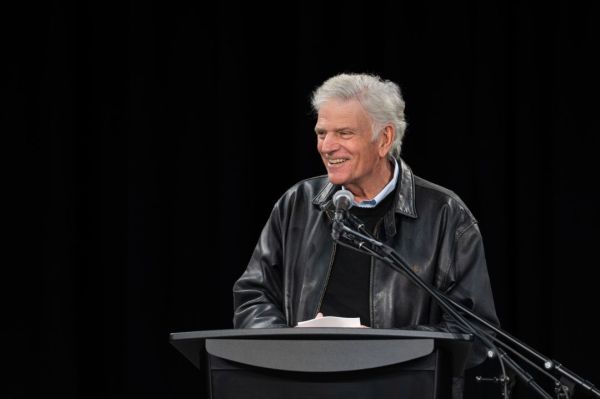

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.