Tapping into positive emotions for successful investing

If you have felt a strong, emotional impulse to sell your investments, believe me, you are not alone. Volatile markets test investors’ resolve and conviction in their strategy. Wealth that took years to accumulate may appear to be evaporating every day as account balances dwindle under the pressure of falling markets.

The field of behavioral finance has studied how an investor’s emotions, biases, and irrational decision-making, especially relevant during times like these, can lead to subpar investing outcomes. A summary of research done in this area is that following your instincts can (and typically does) lead to financial self-sabotage.

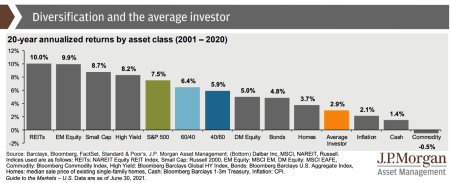

The above chart from J.P. Morgan illustrates that the average investor experienced a 2.9% annualized return over the past 20 years, compared with 7.5% for the S&P 500. While multiple factors impact performance, DALBAR’s annual Quantitative Analysis of Investor Behavior research (started in 1994) concludes that the biggest detractor to performance is poor timing of when the average investor decides to buy, sell, and switch investments. Irrational emotions are thought to be the culprit, triggering investors to sell low and buy back higher, when markets have recovered and feel safer.

Financial advisors are trained to take a more rational approach and encourage clients to do the same, generally ignoring emotion, instinct, or intuition. Instead, they take their cues from software, graphs, and historical data, idealizing a purely academic approach to investing. In fact, inside the financial services industry, anytime someone uses the term “emotion” in the context of investing, it is largely assumed that a poor decision was made. But “emotion” became an undesirable term because it was narrowly referring to a couple of negative emotions, specifically: fear and greed. We all experience these to varying degrees. If left unchecked, they most certainly can sabotage one’s financial future.

But are our emotions always a bad thing when it comes to investing? And is it possible or wise to turn them “off” when it comes to something as significant as investing our life’s savings?

Let’s look at the biblical narrative regarding our design and nature. There, I believe we can find some guidance on how to get our emotions working for us, rather than against us, in a way that could lead to more successful investment outcomes.

The Bible teaches that all people (regardless of their faith) are made in the image of God. See Genesis 1:26-27. Part of God’s nature is logical and orderly, and part of his nature is emotional and passionate. In the Garden of Eden, God pronounced his design of human beings as “very good.” So as a starting point, let’s acknowledge that the complex and intricate design of our human soul is good, even the sometimes messier, emotional part.

Of course, we can also glean from the Scriptures that our emotions should be governed by self-control (one of the fruits of the Spirit listed in Galatians 5:22-23). But rather than forcing a good part of our nature to be silent so we can presumably make savvier decisions, let’s explore positive and productive ways to include our emotional selves in our investing.

Very little research, if any, has been done on the effect of virtuous emotions like compassion, joy, humility, contentment, or patience, on investor behavior and outcomes. While unproven, I believe this concept is worth exploring.

After nearly 20 years of helping clients invest, experience has shown me that emotional engagement and buy-in can be incredibly helpful to investors, especially those motivated by their faith, allowing them to develop a strategy to which they have a higher degree of conviction, allowing them to stay the course more easily in moments of stress. This in turn can mitigate the risk of selling during market downturns, locking in losses, and missing out on the recovery.

Using our emotional intelligence can lead us to better decision-making by helping us consider factors that a merely rational (numbers only) approach might overlook. Investing has many outcomes in the world other than the numbers on your financial statement. Investing choices lead to many different real-world impacts, such as enabling businesses to innovate, care for their customers, meet basic human needs, address slave labor from their supply chains, and provide equitable benefits for their employees.

When we apply compassion in our investing, we can avoid partnering with companies whose products and services harm people (such as tobacco companies) and intentionally choose to channel our capital into positive companies that are serving humanity well. These are valuable outcomes that resonate deeply within our soul and can lead to a sense of emotional satisfaction and contentment when we see them connected with our investment choices.

This approach to investing applies the principle of loving our neighbors in a practical and specific way. Knowing that we are investing in alignment with Jesus’ teachings can give us a feeling of confidence as we are proactive with the decisions that are within our control and trust him with the outcomes. It helps us avoid second-guessing our strategy because we know it’s in alignment with his Word. There’s nothing like a clean conscience to help us sleep well at night, no matter what happens in the market.

Some time ago, I met with one of my clients during a particularly volatile week for investors. She was listening to me describe the companies inside a health care fund that she owned. After hearing about how a new gene therapy treatment was showing very promising results for patients with a degenerative genetic disease, she began to well up. After a long pause to compose herself, she said, “If I can invest in something that meaningful and wonderful, I’m not sure I care if it loses money.”

Her fund did, eventually, recover from the downturn. But the experience highlighted to me the value of an investment approach that truly fits the whole client. This account did not represent her charitable dollars, and yet, when she contemplated the positive impact of her investment, she felt more conviction than ever that her investment was a good choice, despite the drop in value on her statement. She wasn’t gambling. She wasn’t panicking and selling when things got stressful. She was investing intentionally, in alignment with her heart and her head.

In conclusion, while I agree that investors are not well served by timing their trading around their emotions, they can certainly benefit from emotional engagement when developing their investment strategy. Doing so can help ensure a good fit with both the logical mind and emotional mind. The heart of Christian investing is to invest in such a way that it is aligned with our hearts and our heads, and, most importantly, is pleasing to the Lord.

Rachel McDonough is a Certified Financial Planner™ professional, Retirement Income Certified Planner®, and a Certified Kingdom Advisor®. She is passionate about helping both investors and other investment professionals integrate their Christian values into their investment and financial decisions. Rachel founded Wealth Squared (a team of EverSource Wealth Advisors, LLC) with the goal of helping Christian investors create investment portfolios that advance kingdom values while providing income and growth for retirement.