Build Back Better and the Bible

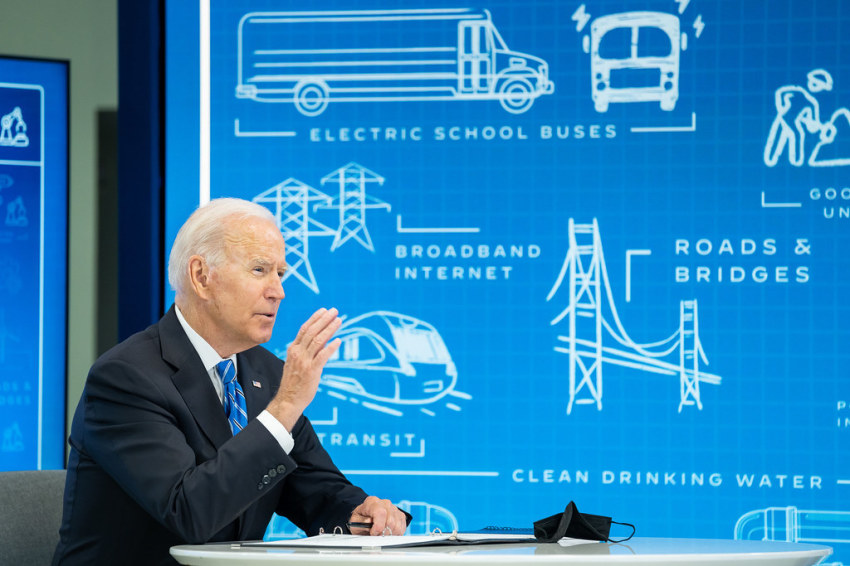

President Biden's Build Back Better plan is somewhat in flux, but as of this writing it looks as though it is likely to include a loophole which would be highly beneficial to wealthy people in high tax states. What light can the Bible shed on policies like this?

First, let's deal with the problem of hyper-spirituality among some Christians. This problem limits God's authority in advance, telling Him which topics He's allowed to talk about in the Bible. In this view, salvation, personal devotion, evangelism, church life, family life, sexual morality are Christian topics. But budgeting, taxation, finance, wealth, poverty, war and peace are not proper Christian topics and should not be discussed in Christian publications.

To all of that I say, who is Lord, God or you? The Bible speaks extensively about topics like this, including taxation. Taxation appears as early as Genesis in the account of Joseph and Pharoah (and perhaps earlier depending on whether one sees the tenth paid to Melchizedek who is both priest and king by Abraham.) The Torah deals extensively with tax issues, Temple taxes, head taxes and various tithes (at least one of which is administered by village elders in the gates, the seat of local government.) God issues warnings about excessive taxes to Israel when it asks to be given a king like the other nations. In addition to high taxation, Israel is warned about favoritism in public budgeting. "And he will take a tenth of your seed and of your vineyards, and give to his officers and to his servants." (1 Sam. 8:15).

The issue that triggered the splitting of the nation in two after the death of Solomon was taxation. In fact, concern over the fear that the David and his dynasty would not deal even handedly between the Tribes/Provinces was an on-going problem. Would David and his progeny favor Judah? Would other provinces have their share in Judah?

And that issue is the same one we are dealing with here, the issue of favoritism between "tribes". Biblical taxes leave little or no room for loopholes or other favors. Tithes are basically flat taxes. The Temple tax is per person. Of course, we aren't ancient Israel, but God is the same God, and even if we can't simply cut and paste Deuteronomy into modern law, the Torah is still the Bible. It is described as perfect and just repeatedly in Scripture (the longest Psalm, 119, is about that topic.) It has principles for us; all scripture is inspired of God and useful for instruction.

The principle is that human nature is flawed and tends towards sin. In government, one of the most common sins in taxation and spending is the sin of favoritism. That's what the warning I quoted above from 1 Samuel is about. Kings have friends and enemies. They reward their friends. David was able to establish some measure of justice (with notable exceptions) partly because he was able to convince tribes other than his own that he would rule them fairly as well. When David's grandson signaled that he would not, ten of the tribes seceded.

We are in some ways in a similar situation now. The "tribes" of America feel that they will not be treated equally when the other side is in power. A great illustration of this is the struggle over whether taxpayers should be given a tax deduction for their state and local taxes (called SALT.) By definition, this deduction favors those who pay the most in state and local taxes, which means wealthy people who live in high tax states. It is worth noting that those high tax states tend to be "blue" states. So, the SALT deduction fight is a lot more than a technical tax issue: it is a proxy for conflicts between blue states and red states.

Prior to President Trump's tax reform, SALT was fully deductible, which arguably was a subsidy for high tax states. Trump's tax plan severely limited that deduction, a blow to high tax states. We can have a reasonable debate about which approach is most just, but the debates have largely been along partisan lines. Democrats, who usually talk positively about taxing the rich, have been fighting for this tax break for the rich, the rich in blue states. Republicans who usually talk positively about lowering taxes for the rich, have now found a tax break they don't like, one for rich people who live in blue states.

This is exactly the sort of thinking the Bible presents as wrong. Rulers are to rule impartially, favoring neither rich, nor poor, treating all tribes equally, not favoring one's own friends and "servants." Now the Democrats are in a position of power, the momentum is towards making the deduction unlimited, offering large favors to states that favor Democrats.

I argue here (The Democrats’ big tax cut for the rich | WORLD (wng.org)) that the loophole subsidizes wealthier taxpayers in higher-taxing wealthier states at the relative expense of poorer states, and I stand by that opinion. But I want to make a bigger point here: we've got to stop thinking in terms of sticking it to our political opponents and start thinking in terms of universal principles that apply whether they help our opponents or not.

A major step in the right direction would be to move away from loopholes in general. That kind of complexity offers fallen human nature a lot of cover for favoritism. Our leaders can emulate the best of David or they can mirror the worst of his grandson Rehoboam. The latter is the path to dissension.

Taxes are complicated and the interplay between state, local and federal taxes is very complicated. I should know; at an earlier phase of my career I worked for the world's largest accounting firm on the SALT team. One way to hide favoritism is secrecy, but an even more effective way is to do in the open things that are so complicated that only tax lobbyists can understand the process by which such rules are made.

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”