China collaboration doesn't pay off for American corporations

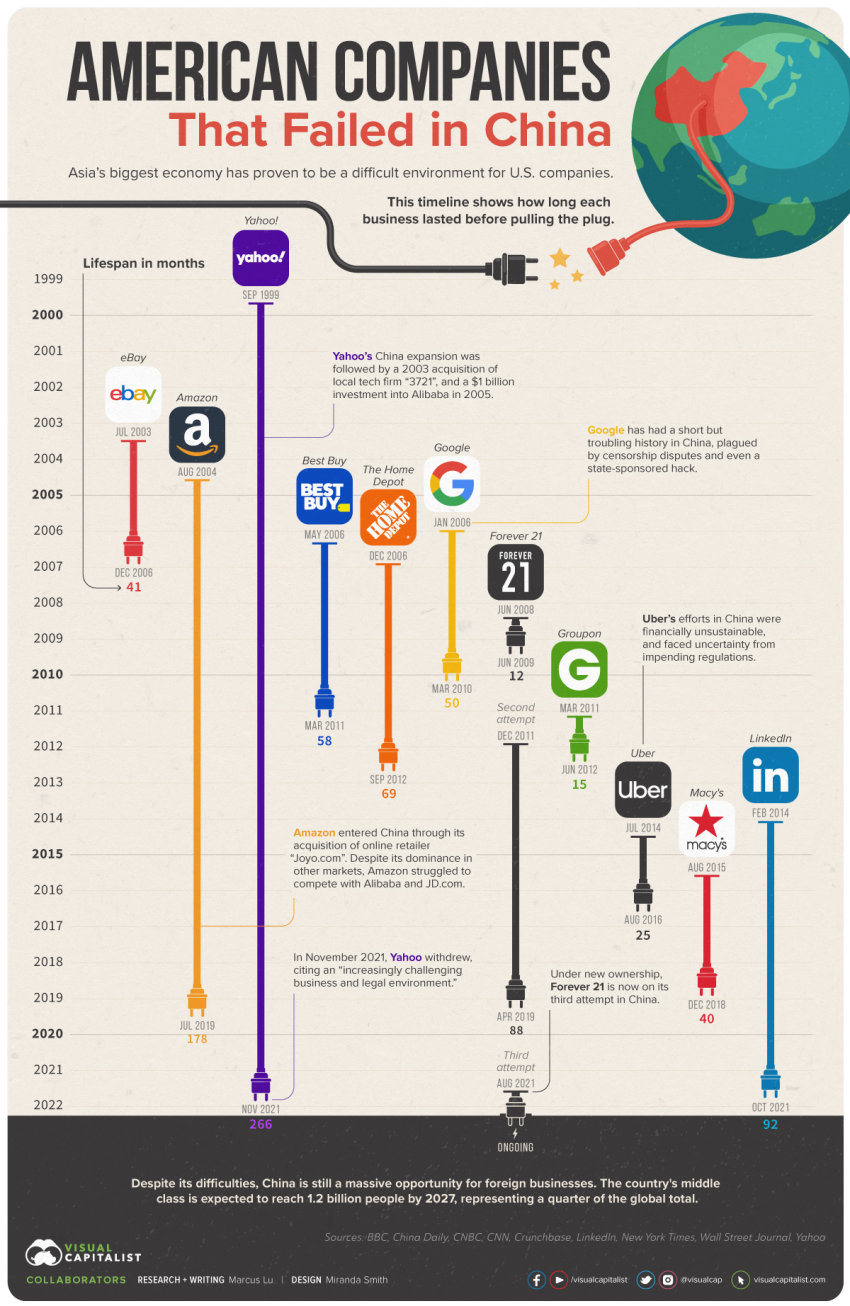

I recently wrote about the Beijing Olympics and the Faustian bargain American corporations made with China. Now that the Olympics are over, that bargain should not be forgotten – and not just because of the moral crime of implicitly endorsing the Chinese government. It’s become fashionable, even automatic, for commentators to deride the corporations that sponsored the Beijing Olympics as “just caring about profit.” (If only that were true, these corporations may have actually ignored the Olympics.) On the contrary, the corporate obsession with China has been anything but profitable. See the infographic below, courtesy of VisualCapitalist, which shows just how successful corporate America’s incursions into China have been:

Put simply, the China bet has been a consistent failure for our corporations. Massive companies, such as Google and Amazon, have been run out of China. Yahoo and Amazon may have had the best run, at over a decade operating something in China before they closed shop, but Google only lasted a little over 4 years. The clothing retailer Forever 21 barely lasted 1 year. The problem isn’t that our corporations haven’t tried – American businesses have been attempting to break into China for years, without success. Sooner or later they either give up or are driven out.

As I said when I previously wrote on the subject, associating your corporation with the Chinese government was a losing move – the universally-negative reputation of the regime domestically likely outweighs whatever benefit a Coca-Cola sign on the railing of some ice rink might bring. The Chinese government lures American corporations in with the promise of access to the world’s largest market, uses their intellectual property to jumpstart their own domestic competitors, and then the companies are forced to leave, either due to direct intervention by the Chinese government or merely an inability to break into a foreign market with its own state-sponsored established competitors.

Purely from the perspective of business profitability, the sponsors of the Beijing Olympics have made a mistake. The Christian case for the primacy of shareholder capitalism is clear: corporate management has been entrusted with the task of maximizing profit for their investors, and it is incumbent upon stewards to be faithful to those who entrusted them with their money. If corporations do not pursue profit on behalf of their shareholders, they are breaking trust with their shareholders and violating the Biblical proscription on faithfulness. No other arguments – for instance, about China’s cultural genocide or persecution of Christians – are necessary to make the moral and practical case against corporate complicity with China.

Ebay, Amazon, Yahoo, Best Buy, Home Depot, Forever 21, Groupon, Uber, Macy’s, LinkedIn. All extremely successful domestically and even internationally. All failed in China, because their government will never allow an American company to compete with their state-owned enterprises long-term. Eventually, American corporations will have to give up on their dream. If they won’t do it of their own volition, their shareholders must speak up against the misuse of investor resources – and against collaboration with the Chinese regime.

Charles is a risk analyst and columnist at TownhallFinance. He has written for National Review Online, AsiaTimes, RealClearMarkets, and the Theopolis Institute. @charlesgbowyer