One Hundred Years of 'No Respect' for Keynesian Economics

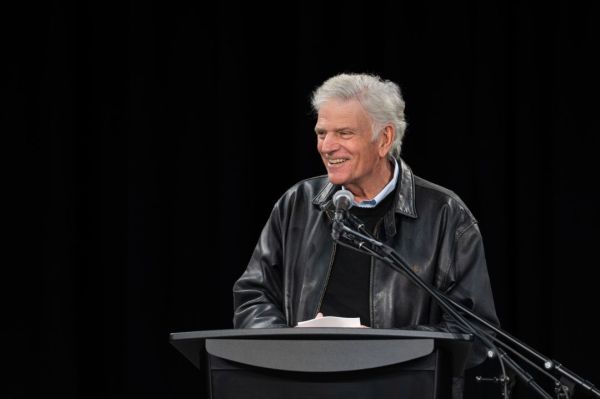

One hundred years ago this month, a brilliant young British economist, Dennis Robertson, published, A Study of Industrial Fluctuations. Economists regard it as a classic in the theory of the business cycle. Yet Robertson is not well known, though he was an economics pioneer who anticipated many ideas that today are associated with others. He was a student of John Maynard Keynes, and his friend and colleague during a fertile period of collaboration in the 1920s.

I bring up this milestone in the history of economics to highlight a shared belief and a polar opposite perspective between the two men, which has had profound effects on us today, and will have profound effects on our children tomorrow. Robertson and Keynes (who were both childless, by the way) were of the shared opinion that more focus be given to economic welfare in the short run. Robertson believed there was too much savings for the benefit of descendants; to the effect it permanently reduced economic well-being. Robertson wanted people to consume more and save less, thereby moderating the business cycle and enhancing economic welfare.

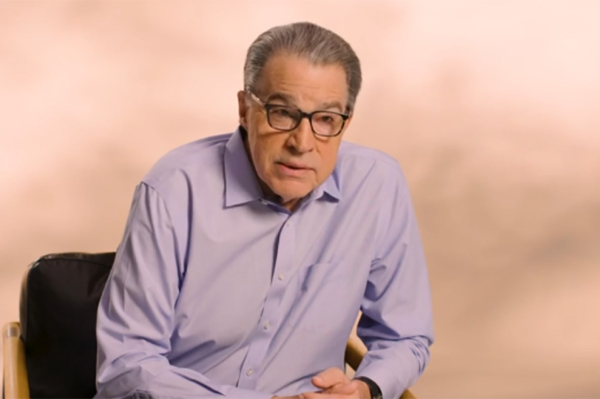

Keynes too, focused on economic prosperity today, not in some distant future. He famously wrote, "in the long run we are all dead". Keynes was even more explicitly against savings. He advocated policies to force dis-saving. He urged the government to borrow savings and spend them now to create income. (This was during the Great Depression, and many, including Robertson, called for similar policies, but with different supporting arguments.)

While both economists agreed people saved too much, Robertson and Keynes strongly disagreed on the way savings impacted the economy. Robertson believed that savings were required to finance business investment, and business investment is needed for growth in the economy. In Robertson's view, thrift was still a virtue, just overdone. People would benefit from a little guidance to make fluctuations less severe. In Keynes view, credit drives investment, which increases incomes, which results in savings. Spending created income; savings did not. He believed savings to be a drag on the economy, not a virtue. Income and "demand" drive the economy, not savings and capital accumulation.

Keynes won the argument of the day. Since 1937 economic policy has been decidedly Keynesian. Policy makers are focused on the short term. Savings is not important, demand is important. A hundred years of no respect for savings is reflected in the debt levels of the United States, Europe, and Japan. According to data from the Federal Reserve, total debt in the United States (household, business, government and finance) is now 350% of GDP, compared to the historically stable 150% of GDP that prevailed before Keynesian economics. It's hard to appreciate the true impact of this level of debt, especially at today's artificially low interest rates. If interest rates ever go back to "normal", 20% or more of national income will be needed just to service the debt.

Far from being overly concerned about providing for their descendents, these Keynesian economies have been busy borrowing from their descendents. We are approaching the end of the game for Keynesian economics. As the burden of servicing debt rises, the capacity to borrow even more from the future falls. We will soon have to rediscover the virtues of thrift, and learn again to finance investment out of savings. Robertson may yet get his due.