Ask Chuck: Should I borrow for a wedding?

Dear Chuck,

A friend suggested we get a home equity loan to cover our daughter’s wedding this summer. This makes me very uncomfortable, but I want my daughter to have her big day.

Money for Matrimony

Dear Money for Matrimony,

I have a very wise friend that always responds to my questions with the same reply: “This is a question that demands some education!” What he is somewhat jokingly telling me is that he will explain the why behind his answer before he actually answers. Well, I sense the same opportunity with your question. I need to talk about home equity loans before I talk about financing your daughter’s wedding.

Understanding a Home Equity Loan

A home equity loan is a type of second mortgage. Funds are taken from the equity — the difference between the home’s value and the mortgage balance — and repaid over a certain period of time. For some, it is an easy and practical way to access cash. Equity is typically used for big expenses and can be more cost-effective than credit cards or personal loans with high interest rates. These loans average 6.36% compared to 15.96% for credit cards and 11.79% for personal loans (March 29, 2021).

Home equity fluctuates based on the market. Currently, home prices are climbing in much of the United States, but property values could plunge should we experience some catastrophic event. In 2007, home prices hit a high, then they steadily fell 35% by 2012.

A Motley Fool article at fool.com, “The Only 4 Reasons to Use Home Equity Loans,” approves these uses:

- Home improvements that add value

o Know what buyers will pay for in that location - Emergency expenses

o Large medical bills, prolonged unemployment, or an unexpected situation - Consolidating high-interest debt

o Requires discipline to repay and the ability to stop adding to debt - Funding investment properties

o Only if the total mortgages are less than 80%, rent covers the payments, and the property is in high demand

Not So Fast or Easy

I understand the first three as possible justifiable reasons; however, I do not recommend borrowing money to make any investment.

Michele Hammond, of Chase Private Client Home Lending, notes that applicants’ debt-to-income ratio, loan-to-value ratio, credit score, and annual income are checked. “Additionally, to determine the amount of equity in a home, a lender will employ an appraiser to determine the current market value of the home, which is based on its conditions and comparable properties in the area.”

If the money is used for home improvements, make sure they actually increase the home’s value and marketability. This website provides job cost and resale data for different regions of the country.

My Straight Answer

I don’t like the idea of using a home equity loan to pay for your daughter’s wedding. While you could pay for a nice experience for her, borrowing money puts your entire family at unnecessary risk.

Although a repayment plan must be in place for the loan, the same need for cash could arise in the future. Using the cash to cover debt or luxury lifestyle choices can compound a spending problem. Late payments could impact your credit score. Defaulting could mean losing your home.

Some Options

Do your homework to avoid the possible pain and stress of two mortgage payments. The pandemic has impacted the employment of many Americans. Analyze your income and employment situation, and put your pencil to the numbers to determine how much wedding you can afford without debt. Talk this over with your daughter.

When Jesus told a crowd (Luke 14:25-33) to consider the cost of discipleship, He gave an illustration: “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?” This diligence and analysis is necessary for every big decision we face in life.

It is possible to do a cash out refinance. Rates are beginning to rise, but they may be lower than your current mortgage. Talk to several lenders, know all the costs involved, and pray for wisdom to determine if you should proceed. Seek counsel from those who understand the pros and cons.

Look at alternative ways to host the wedding that reduce the typical costs. Here are a few ideas: ask friends to help you crowdsource flowers, look for venues that are less expensive to rent, and seek volunteers for music, pictures, and even meals for the rehearsal and/or reception. Frugal weddings are nothing to be ashamed of. Years ago, I read a survey that weddings featuring low costs but a high number of guests produced longer lasting marriages than high cost weddings with fewer guests.

Be encouraged and patient. I am not sure how long you have before the big day, but disciplined spending and saving now can help you avoid borrowing. My hope is that this information will help you show the maximum amount of love and support to your daughter and future son-in-law, with the minimal amount of financial stress.

Want to Stay Connected with Crown?

I spoke about finding Renewed Hope in Crown’s Winter update; you can view the 15 minute video here. Join me for more encouragement during our Spring update on Renewed Faith on April 22nd. The virtual event is free, but registration is required, so sign up today.

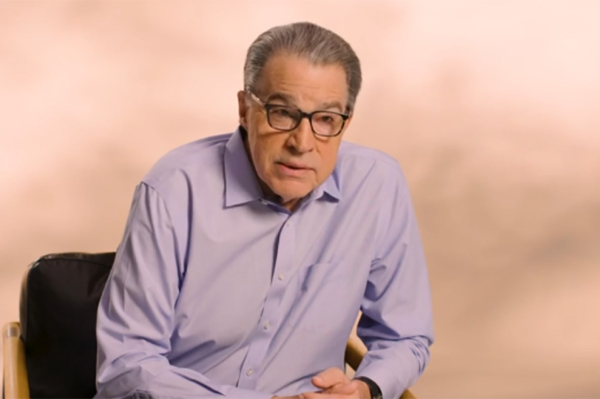

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Seven Gray Swans: Trends that Threaten Our Financial Future. Be sure to follow Crown on Facebook.