Dow Falls Over 200 Points at Open Bell

The Dow fell over 200 points at Wall Street’s open Monday morning, following Standard & Poor’s recently announced downgrade of U.S. debt.

At about 10:30 a.m. the Dow Jones Industrial Average sank more than 300 points, down about 3 percent. S&P dropped 42 points or 3.5 percent and Nasdaq fell over 100 points, just under 4 percent.

Investors are monitoring the Dow, hoping that the high sell-off from last week will not continue. U.S. stocks plummeted 512 points on Thursday, August 4, a decrease that has not been seen since the 2008 financial crisis.

"It's not a rush to the exits. The market is trying to find a level where it has support but it will continue to be volatile throughout the day," Ken Policari of ICAP Equities told ABC News.

Asian stocks experienced a significant drop Monday, increasing fears of a slowdown in economic growth.

Major Asian markets such as Hong Kong’s Hang Seng fell 3.5 percent and South Korea’s Kospi dropped 3.3 percent. Also, Japan’s Nikkei 225 stock average slipped 2.2 percent.

Markets in London, Paris, and Frankfurt were also trading lower on Monday. Stocks dropped between 1 percent to about 2.5 percent. European Central Bank is attempting to offset the continent’s debt crisis by buying Spanish and Italian bonds.

Finance ministers and central bank governors said they planned to “take all necessary measures to support financial stability and growth.”

Some analysts say this would transfer significant risk to the balance sheet and others believe it would barely put a dent in Europe’s debt crisis.

Investors are waiting to see exactly how the S&P downgrade will affect the Dow. The U.S. credit rating was lowered from AAA to AA+, the first in American history.

The White House called Standard & Poor’s decision “amateurish” and “breathtaking,” ABC News reports.

U.S. treasury officials found a $2 trillion dollar error in S&P’s findings, however the ratings firm still went ahead with their decision.

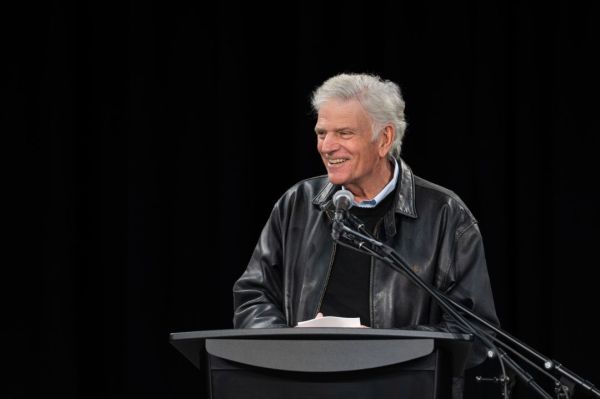

David Beers, global head of sovereign ratings at Standard & Poor’s, told ABC News he absolutely did not have any second thoughts about the decision to downgrade the U.S. debt rating.