Uncertain leadership and volatile currencies are causing global financial uncertainty

Last week the dollar rose to 30 year highs in relation to other global currencies.

That's not a good thing.

Currencies are supposed to be stores of value and when they are fluctuating against one another in wide swings it's always harmful. Most hurt will be the poorer nations of the world which we see anticipated by the sell-off in underdeveloped (often called "emerging market") nations. This is the fruit of a worldview of elitism which overestimates the capacity of an expert class to manage the world based on academic theories, rather than permanent principles.

For example, under the fixed weights and measures of the classical gold standard, the major economies of the world did not have to suffer the chaos and booms, and then the inevitable busts, like the one we're suffering now.

Big Picture: Last week was almost entirely about the dollar, especially in relation to the British Pound. Prior to last week the dollar had risen to near 30 year highs in relation to major currencies. This has happened for two reasons: First, the Fed policy has caused interest rates to rise. That means international investors can get a better interest rate by buying our bonds, but in order to buy our bonds, they have to buy our dollars. That's why the dollar gets stronger. But the strong dollar is not just a matter of the attractiveness of high interest rates: yes, the US interest rate is up to roughly 3%, but the Russian interest rate is almost 8%. Has that caused a strong ruble? No, because Russia is too risky. The US offers an attractive balance of yield and riskiness, and that's why demand for dollars is high, causing the greenback to rise in value relative to most of the world.

But when the dollar becomes too strong, it can hurt the economy, disrupting trade relations by making our exports too expensive (because in order to buy US goods, foreigners must first buy the currently very expensive US dollar). Last week, the fall of the pound against the dollar dominated headlines and markets concluded that the Fed was probably going to have to do something about that. Futures markets shifted, implying that Fed hikes will be smaller than expected.

Interest rate futures fell slightly. Commodities rose. Gold rose. Bitcoin rose. The dollar fell. U.S. Equities outperformed global equities.

Gold rose more than the dollar fell, which means that only some of the rise of the price of gold in dollars was due to weakening dollar. This suggests that last week global fear drove demand for gold higher, which fits with foreign equity underperformance. Commodities rising is consistent with the expectation that the Fed just might take its foot off the brake a little more than expected to avoid a global crash.

These comparative returns between asset classes such as stocks, bonds, currencies and commodities fit the story of slightly less tight Fed, slightly better US growth, and lower global growth. We'll see below whether the comparative returns of different sectors within asset classes also told the same story as the comparative returns between asset classes. Spoiler: they do (mostly).

This coming week the data release schedule will contain two big themes. First, various purchasing (i.e. supply chain) manager surveys will be released shedding light on whether we're slipping back into negative growth. Second will be various employment reports. If the purchasing manager surveys are weak that will likely be interpreted as another sign that the Fed will go a little soft in the inflation fight. Weak employment reports would reinforce that message. Or, of course, both sets of data could be strong and then this coming week's market dynamics would likely reverse again, switching from expectations of an easier Fed back to expectations of a tougher Fed. That's what happens when the Fed is the single largest investor, if it changes its mind, markets change accordingly.

Real Estate: REITS performed quite poorly, as one would expect given the very high mortgage rates. In some ways REITs do not fit some of the other themes of the week, slightly better growth expectations and slightly lower Fed targets and treasury rates. However, the specific rate, mortgage, which is highly relevant for real estate seemed to be the bigger driver.

REITs performance is typically between that of equity markets and bond markets; however, last week it fell short of both, likely because of the three factors mentioned above.

Domestic Stock Market: Equity markets were down for the week. Growth stocks tend to outperform value stocks during times of improving economic growth expectations (because growth presumably helps earnings actually deliver on growth companies' high expectations). Last week that's exactly what happened, and in all size buckets. Large cap growth fell less than large cap value. Ditto for mid cap growth and value and also for small cap growth and value. This pattern reflects both a slightly improving (U.S.) growth outlook and a shift downward in interest rate expectation. The latter is because growth stocks are dependent on a longer time horizon, which means that the interest rate which is used to discount future earnings has more years in which to have a larger impact.

Sectors told the same story. Cyclicals (which are designed to benefit from growth) beat defensive funds (which are designed to be recession hedges). Consumer discretionary funds returns (which rely on growing prosperity leading consumers to buy more optional items) exceeded consumer staples (which are made up of things people keep buying even when times are tough) and utilities (another essential). Utilities, a classic recession hedge, underperformed growth-oriented sectors, which means investors saw less probability of a recession to hedge against. Rising energy (and other industrial commodities) explain why materials were arguably the best sector, another more optimistic "growth" trade. Of course, in the current market dynamics, shifts in optimism are more like shifts towards less pessimism. Markets seem convinced that we're in for a slow-down. The optimists are the ones who expect a small downturn.

International Markets: International equity markets were down for the week, more so generally than most domestic equity markets. This was despite the tailwind of a falling dollar. In other words, the international underperformance would have been even worse if not for the fact that their currencies were rising in value against the dollar.

EM significantly underperformed DM across the world. Last week's international equity story was not a geographical one, it was a developmental one. When the US raises rates, it attracts capital from around the word, for the reasons we discussed above. This especially pulls money away from the periphery, the emerging world. In general EM markets are more volatile than the developed world and so the ups and downs tend to be bigger. Last week was a global down which means for EM it was a bigger global down.

Bond Markets: Bond markets were down slightly last week, although equities were down quite a bit more. The comparison between stocks and bonds looks like a pessimistic trade. Also, comparing different types of bonds looks like a shift towards greater pessimism. The differences between treasuries and corporate bonds were consistent with decelerating growth, with corporate bonds significantly underperforming treasuries. Within the corporate bond sector, different credit quality groups sent the same signal, with high yield bonds performing particularly badly. These signals conflict with the growth signal sent by comparing different bond sectors.

Perhaps the market signal reflects a shift towards growth pessimism in general, or perhaps it is related to falling inflation expectations. Inflation helps debtors, and high yield ("junk bonds") generally are bigger debtors. If the Fed dampens inflation, then they have more to lose.

This does fit with the data from inflation-protected treasuries (TIPS), which under-performed non-inflation-protected treasuries. This caused the yield spread between them to narrow, an indicator of a lowering of inflation expectations. Remember, when the price goes down, the yield goes up. So if the price of TIPS goes down more than the price of regular treasuries, then the yield of TIPS goes up more than the yield of regular treasuries, which narrows the gap between them. This market signal conflicts a bit with the inflationary message of a falling dollar and rising gold and rising Bitcoin.

Once again, last week bonds dissented from other asset classes in what they are implying about the future. The bond market seemed to dissent from equity markets in its outlook signaling less growth optimism. And TIPS' disinflationary signal dissented from currencies and commodities' inflationary one.

This chaos is what comes when wisdom is absent from the high places of economic leadership in our world.

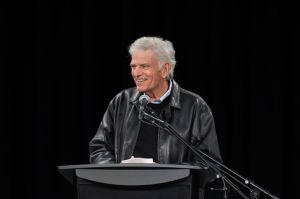

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”