Ask Chuck: Should I buy a house in this booming market?

Dear Chuck,

The real estate market in our area is booming! We are thinking of buying an upgraded home with these low rates but are worried we may not be able to find what we really want or need. Can you give us some tips?

Homebuying Fever

Dear Homebuying Fever,

We are in the midst of a real estate boom across the country so be patient. This is what is called a “seller’s market.”

Low mortgage rates and high demand have created an inventory shortage around the country. This is driving up prices. Usually, sales begin to taper off in the fall but, this year, buying remains unusually active.

Ann and I have purchased six homes in our 42 years of marriage. We have learned a lot of lessons – things to do and things NOT to do! I will gladly give you lots of tips.

There are three essential steps before making the decision to change from your current home: research, pray, and seek wise counsel.

Research Before Buying

When buying a home, location is key. Always consider a resale scenario and try to buy what others would want. Do not buy somebody else’s problem. Be sober-minded. Avoid letting your emotions override facts. Power lines, busy streets, flooding, poor floor plan, and length of time on the market are just a few red flags that you absolutely should not ignore.

Do some extra homework. Know the typical price per square foot in the location where you want to buy, and aim to stay within that range. Again: think resale.

Drive to the house at different times of the day. Study traffic patterns, observe people, and talk to neighbors. Do they like living there? Does everyone get along? Are there issues within the homeowner’s association? How are the schools? Is crime an issue? Are properties well-maintained? What are the covenants? Can the home be rented out? Are VRBOs or Airbnbs allowed?

If you work from home, determine where and how it would work in the house. If you exercise hospitality, be sure to analyze parking, dining, gathering, and sleeping space. If you plan to stay there for a long time, are there stairs? Is the primary bedroom on the main floor? Can you access or adapt areas if a wheelchair is needed? Is there room to accommodate parents or adult children who may need a place to land at some point? Are there any immediate repair or remodel costs?

Make sure you have a quality inspection performed and that all issues are resolved in advance. I can tell you nightmare stories about buyers who “fell in love” with a home only to find out later it was a money pit of maintenance problems.

Spend less than that for which you qualify. Being ‘house poor’ creates tremendous stress in a marriage. Don’t invite it in.

Remember, there is nothing wrong with renting. It can provide the flexibility that home-ownership cannot. A rent vs. buy calculator may ease your mind.

Refinancing

With historic low rates, your best option may be to refinance where you are and pay it off quickly.

I remember talking to a banker when closing on our first house in the ’80s when the only loans available were 3- and 5-year adjustable-rate mortgages (ARMs). He told me we would never see 30-year fixed-rate mortgages again. Yet, here we are with the lowest 30-year and 15-year fixed rates in my lifetime.

If you are in a position to refinance, use our calculator to understand different scenarios. Shop around and familiarize yourself with different lenders and rates. Study the reviews of individual brokers with the lender you choose. Gather essential documents and work diligently to complete the process in a timely fashion.

Important Considerations:

- Compute the time to recover closing costs. Avoid selling prior to that time.

- Lock into a fixed rate.

- Compare APRs, not just interest rates, to get a clear picture of all fees involved.

- Aim to eliminate private mortgage insurance (PMI).

- A shorter length loan will reduce interest paid but possibly raise monthly payments. Lower payments with a longer term will increase the overall interest charges.

- Read the fine print. Have someone experienced in lending help you understand what you are signing. Can you prepay the loan without penalty? What are the late payment penalties? How long before a home goes into foreclosure?

- Drawing equity out of a home for available cash can be dangerous. If home prices drop you could end up underwater. If your equity falls below 20% you will have to pay PMI again.

- Seek a mortgage rate lock as a guarantee for a specific period of time.

Remodeling

Many people are fixing up their existing homes. Before moving, consider adding on or remodeling the home you are in now.

This, on top of the disruption created by Covid-19, has created a lumber shortage and elevated prices. Some building supplies and sub-contractors are backed up for weeks, even months. Homeowners must take this into consideration if making plans.

Study trends and think resale when planning projects.

This is Not Permanent

When buying, refinancing, or remodeling, you must think about resale. Very few people stay in one home for their entire life. Again, research, pray, and seek wise counsel on any of these options as well.

Remember that wherever believers make their earthly home, they always have a better one. It’s being prepared for us and one day Jesus will come and take us there (John 14:1-7 ESV). Let us not lose sight of the eternal by the busyness of the temporal.

In the midst of the real estate boom, may we keep our priorities in check and join the Apostle John in saying, “Come, Lord Jesus!” (Revelation 22:21 ESV)

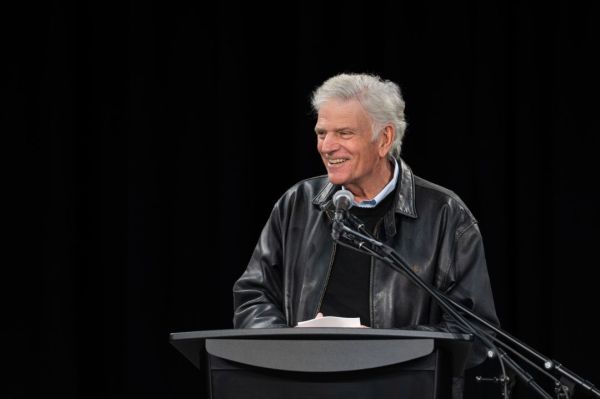

My wife, Ann, and I are doing a new podcast to help families with their finances. It is called “Family & Finances, Stories of Failure and Success.” I think you would enjoy listening to our real estate stories and many of our other lessons on a variety of topics. Thanks for your question.

Chuck Bentley is CEO of Crown Financial Ministries, the largest Christian financial ministry in the world, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Money Problems, Marriage Solutions. Be sure to follow Crown on Facebook.