On Tough Choices, Both Candidates Lack Details

With a national debt surpassing $16 trillion and a pending "fiscal cliff" that threatens to send the economy into recession, both presidential candidates, Mitt Romney and Barack Obama, agree on the need for entitlement reform and tax reform, but both candidates lack some specific details about which reforms they would support.

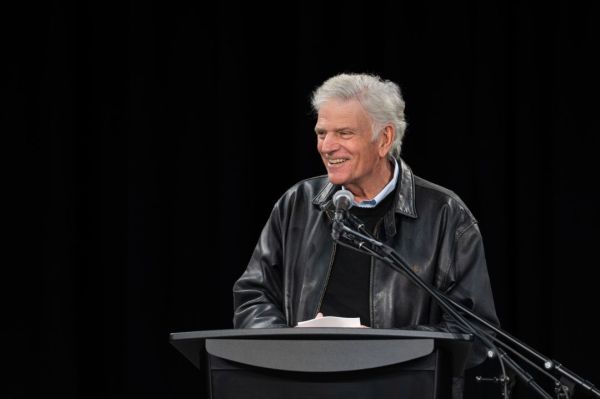

"Let me ask you, in a second term, what is the president proposing to do to reform Social Security, save if for future generations, and will it involve lower benefits for anyone or higher taxes for anyone?" Time magazine journalist Mark Halperin asked David Axelrod, chief strategist for the Obama campaign, Monday on MSNBC's "Morning Joe."

After Axelrod said Obama would reform Social Security in a "balanced way," but offered nothing specific, Halperin repeated the question: "What's his proposal?"

Axelrod answered that the specifics would be up to Congress.

"Mark, I'll tell you what. When you get elected to the United States Senate, we'll sit at that table. We'll have -- this is not the time. We're not going to have that discussion right now unless the Congress wants to sit at a table and say, OK, we're ready to move on a balanced approach to this," Axelrod said.

In a blog post for Time, Halperin noted the hypocrisy in Axelrod's answer. The Obama campaign has relentlessly criticized Romney for not stating which tax deductions he would support abolishing in his tax reform plan.

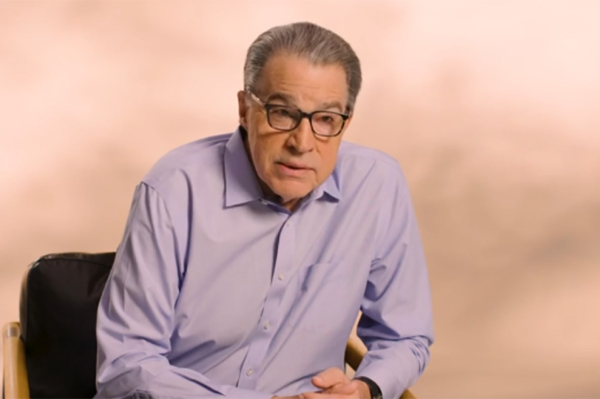

The Romney plan is to cut all the tax rates by 20 percent while also doing away with deductions and credits. The amount raised by eliminating those tax preferences would equal the amount lost by reducing the rates. The plan does not specify, though, which deductions or credits should be eliminated. When asked about this, Romney or his campaign surrogates answer that Congress would need to decide which deductions or credits to eliminate.

"You're asking the American people to hire you as president of the United States. They'd like to hear some specifics," journalist Scott Pelley told Romney in an interview on CBS' "60 Minutes," which aired Sunday.

Romney responded, "Well, I can tell them specifically what my policy looks like. I will not raise taxes on middle income folks. I will not lower the share of taxes paid by high income individuals. And I will make sure that we bring down rates, we limit deductions and exemptions so we can keep the progressivity in the code, and we encourage growth in jobs."

Pelley then pressed again, saying, "And the devil's in the details, though. What are we talking about, the mortgage deduction, the charitable deduction?"

"The devil's in the details. The angel is in the policy, which is creating more jobs," Romney answered.

Halperin summed up the situation succinctly: "So the President's position on Social Security seems to be the same as Mitt Romney's on tax deduction changes -- there should be no real details or debate to inform voters before the election."